Intercontinental Exchange, Inc. (ICE) is an American network of exchanges and clearing houses for financial and commodity markets. ICE owns and operates 23 regulated exchanges and marketplaces; ICE futures exchanges in the US, Canada and Europe, Liffe futures exchanges in the US and Europe, New York Stock Exchange, Equity options exchanges, OTC energy, credit and equity markets. ICE also owns and operates 5 central clearing houses; ICE Clear Europe, ICE Clear U.S., ICE Clear Canada, ICE Clear Credit, and The Clearing Corporation. Headquartered in Atlanta, Georgia, ICE has offices in New York, London, Chicago, Houston, Winnipeg, Amsterdam, Calgary, Washington, D.C., San Francisco and Singapore.

History

Jeffrey C. Sprecher, founder, chairman, and Chief Executive Officer, was a power plant developer who spotted a need for a seamless market in natural gas used to power generators. In the late 1990s, Sprecher acquired Continental Power Exchange, Inc. with the objective of developing an Internet-based platform to provide a more transparent and efficient market structure for OTC energy commodity trading.(Popper 2013)

In May 2000, ICE was founded by Sprecher and backed by Goldman Sachs, Morgan Stanley, BP, Total, Shell, Deutsche Bank and Société Générale who represent some of the world's largest energy traders.

The new exchange offered the trading community better price transparency, more efficiency, greater liquidity and lower costs than manual trading. While the company's original focus was energy products (crude and refined oil, natural gas, power, and emissions), acquisitions have expanded its activity into soft commodities (sugar, cotton and coffee), foreign exchange and equity index futures.

In a response to US financial crisis in 2008, Sprecher formed ICE US Trust based in New York, now called ICE Clear Credit LLC, to serve as a limited-purpose bank, a clearing house for credit default swaps. Sprecher worked closely with the Federal Reserve to serve as its over-the-counter (OTC) derivatives clearing house. "US regulators were keen on the kind of clearing house for opaque over-the-counter (OTC) derivatives as a risk management device. In the absence of a central counterparty - which would guarantee pay-outs should a trading party be unable to do so - there was a high risk of massive market disruption(Weitzman 2008)"

The principal backers for ICE US Trust were the same financial institutions most affected by the crisis, the top ten of the world's largest banks (Goldman Sachs, Bank of America, Citi, Credit Suisse, Deutsche Bank, JPMorgan, Merrill Lynch, Morgan Stanley and UBS). Sprecher's clearing house cleared their global credit default swaps (CDS) in exchange for sharing profits with these banks.(Weitzman 2008)(Terhune 2010). By 30 September 2008 the Financial Post warned that the "$54000bn credit derivatives market faced its biggest test in October 2008 as billions of dollars worth of contracts on now-defaulted derivatives would be auctioned by the International Swaps and Derivatives Association . In his article in the Financial Post,(Weitzman 2008) described ICE as a "US-based electronic futures exchange" which raised the stakes on October 30, 2008 in its effort to expand in the $54000 bn credit derivatives market.(Weitzman 2008)

By 2010, Intercontinental Exchange had cleared more than $10 trillion in credit default swaps (CDS) through its subsidiaries, ICE Trust CDS (now ICE Clear Credit).(Terhune 2010)

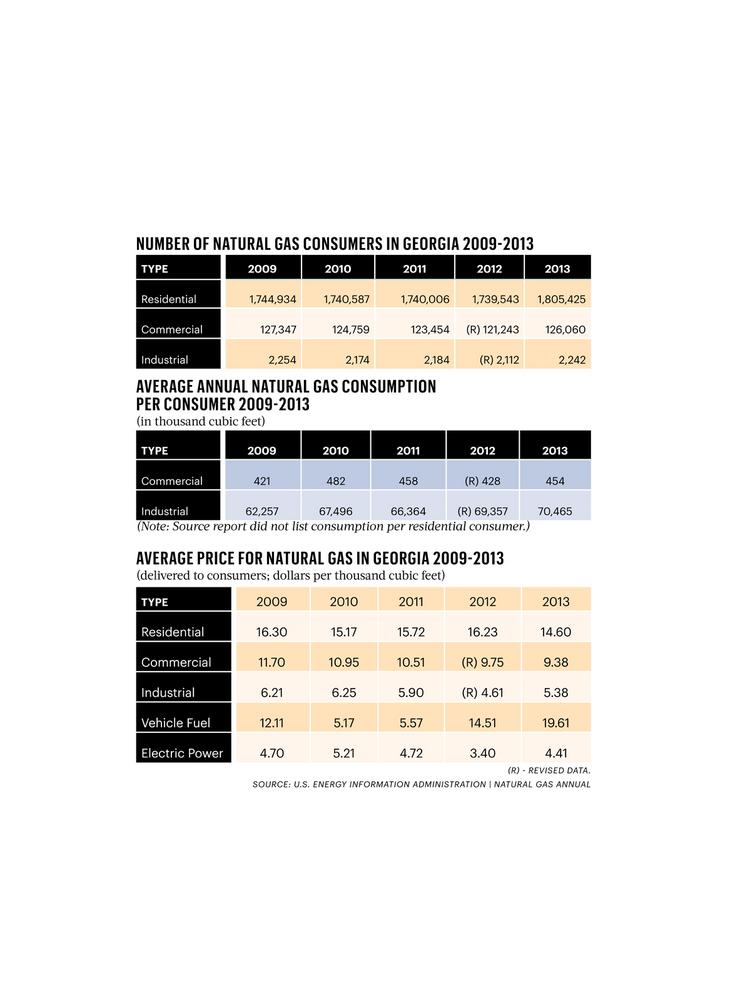

Natural Gas Rates In Atlanta Video

Mergers and acquisitions

The Intercontinental Exchange has had a policy to grow through the acquisition of other exchanges, a number of these have been successful while others have failed due to concerns by regulators or others that the new company would have created a monopoly situation. The major acquisition and attempted acquisitions have included:

International Petroleum Exchange (IPE) 2001

In June 2001, ICE expanded its business into futures trading by acquiring the London-based International Petroleum Exchange (IPE), now ICE Futures Europe, which operated Europe's leading open-outcry energy futures exchange. Since 2003, ICE has partnered with the Chicago Climate Exchange (CCX) to host its electronic marketplaces. In April 2005, the entire ICE portfolio of energy futures became fully electronic and ICE closed International Petroleum Exchange's high profile and historic trading floor.

New York Board of Trade (NYBOT) 2005

ICE became a publicly traded company on November 16, 2005, and was added to the Russell 1000 Index on June 30, 2006. The company expanded rapidly in 2007, acquiring the New York Board of Trade (NYBOT), and ChemConnect (a chemical commodity market).

Chicago Board of Trade Unsuccessful Bid 2007

In March 2007 ICE made an unsuccessful $9.9 billion bid for the Chicago Board of Trade, which was instead acquired by the Chicago Mercantile Exchange.

Winnipeg Commodity Exchange (WCE) 2007

IntercontinentalExchange Inc., the "upstart Atlanta-based energy bourse" purchased the privately held 120-year-old Winnipeg Commodity Exchange, known for its canola futures contract, for $40 million.

The Winnipeg Commodity Exchange (WCE) was renamed ICE Futures Canada as of January 1, 2008. In 2004, the Winnipeg Commodity Exchange had "closed its open-outcry trading floor" becoming "the first North American agricultural futures exchange to trade exclusively on an electronic platform" by trading via the "Chicago Board of Trade's electronic platform, and [using] clearing services from the Kansas City Board of Trade. IntercontinentalExchange converted Winnipeg Commodity Exchange contracts to the IntercontinentalExchange platform. IntercontinentalExchange maintained an office and "small core staff" in Winnipeg, Manitoba. The Manitoba Securities Commission oversee its operations.

TSX Group's Natural Gas Exchange Partnership 2008

In January 2008, ICE partnered with Canada's TSX Group's Natural Gas Exchange, expanding their offering to clearing and settlement services for physical OTC natural gas contracts.

Climate Exchange 2010

In April 2010, ICE acquired Climate Exchange PLC for 395 million pounds ($622 million) and European Climate Exchange (ECX) as part of its purchase. Exchange-traded emissions products were first offered by the European Climate Exchange (ECX), which was established in 2005, by listing products on the ICE Futures Europe's trading platform. ICE Futures Europe is the leading market for carbon dioxide (CO2) emissions. ICE's ECX products comply with the requirements of the European Union Emission Trading Scheme.

NYSE Euronext 2013

In February 2011, in the wake of an announced merger of NYSE Euronext with Deutsche Borse, speculation developed that ICE and Nasdaq could mount a counter-bid of their own for NYSE Euronext. ICE was thought to be looking to acquire the American exchange's derivatives business, Nasdaq its cash equities business. As of the time of the speculation, "NYSE Euronext's market value was $9.75 billion. Nasdaq was valued at $5.78 billion, while ICE was valued at $9.45 billion." Late in the month, Nasdaq was reported to be considering asking either ICE or the Chicago Merc (CME) to join in what would be probably be an $11-12 billion counterbid for NYSE. On April 1, ICE and Nasdaq made an $11.3 billion offer which was rejected April 10 by NYSE. Another week later, ICE and Nasdaq sweetened their offer, including a $.17 increase per share to $42.67 and a $350 million breakup fee if the deal were to encounter regulatory trouble. The two said the offer was a $2 billion (21%) premium over the Deutsche offer and that they had fully committed financing of $3.8 billion from lenders to finance the deal.

The Justice Department, also in April, "initiated an antitrust review of the proposal, which would have brought nearly all U.S. stock listings under a merged Nasdaq-NYSE." In May, saying it "became clear that we would not be successful in securing regulatory approval," the Nasdaq and ICE withdrew their bid. The European Commission then blocked the Deutsche merger on 1 February 2012, citing the fact that the merged company would have a near monopoly.

In December 2012, ICE announced it would buy NYSE Euronext for $8.2 billion, pending regulatory approval. Jeffrey Sprecher will retain his position as Chairman and CEO. The boards of directors of both ICE and NYSE Euronext approved the acquisition.

SuperDerivatives Inc 2014

In September 2014, ICE announced that it had entered into a definitive agreement to acquire SuperDerivatives, a leading provider of risk management analytics, financial market data and valuation services. The acquisition was said to accelerate the expansion of ICE's comprehensive multi-asset class clearing strategy. Terms of the all-cash transaction included a purchase price of approximately $350 million. Completion of the transaction was subject to regulatory approval and other customary closing conditions. The transaction successfully completed on 7 October 2014.

Operations

ICE provides exchange trading and clearing services in a number of different markets. Its main products include:

- Exchange traded futures and options

- Agriculture

- Financials

- Crude Oil and Refined

- Electricity

- Natural Gas/Liquids

- UK Natural Gas

- Other

- Over-the-counter instruments (ICE OTC)

- Crude Oil and Refined

- Natural Gas

- Electricity

The company is split into the following subsidiaries:

- Markets

- ICE Futures U.S.

- ICE Endex

- ICE Futures Canada

- ICE OTC

- ICE Futures Europe - one of the world's largest energy futures and options exchanges

- Clearing

- ICE Clear U.S.

- ICE Clear Europe

- ICE Clear Canada

- ICE Clear Credit

Are You Looking for Products

Here some products related to "Intercontinental Exchange".

Samlex Solar PST-300-12 P..

Amazon.com : Underberg Na..

Amazon.com : Underberg Na..

Harman Kardon GPS-810 4.3..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon